Hsbc hong kong swift code wire transfer

- SWIFT/BIC Code: HSBCHKHHHKH

- HSBC: Bank identifier for Hongkong and Shanghai Banking Corporation Limited.

- HK: Country code for Hong Kong.

- HH: Location code for the head office in Hong Kong.

- HKH: Branch identifier, indicating this is the primary office handling all Hong Kong operations.

- Bank Name: Hongkong and Shanghai Banking Corporation Limited (HSBC).

- Address: 1 Queen’s Road Central, Central and Western District, Hong Kong.

- HSBCHKHHHKH is the primary SWIFT code for HSBC Hong Kong and is used for most international wire transfers to personal or business accounts under HSBC in Hong Kong.

- This code directs funds to the head office, which then processes them to the specific account or branch. It’s suitable for general use unless a specific branch code is required (e.g., for specialized services like securities or treasury, which are less common for standard transfers).

- SWIFT Code: HSBCHKHHHKH.

- Bank Name: Hongkong and Shanghai Banking Corporation Limited.

- Recipient’s Full Name: As it appears on your HSBC account.

- Account Number: Your HSBC Hong Kong account number (typically 12 digits).

- Bank Address: 1 Queen’s Road Central, Hong Kong.

- Purpose of Transfer: Some transfers, especially in HKD or RMB, may require a reason for compliance (e.g., personal remittance, business payment).

- Currency Considerations: HSBC Hong Kong supports multi-currency accounts. Specify the currency (e.g., HKD, USD) to avoid unnecessary conversions. For USD transfers, ensure the sender uses a correspondent bank if required (HSBC often uses its own network, but confirm with your bank).

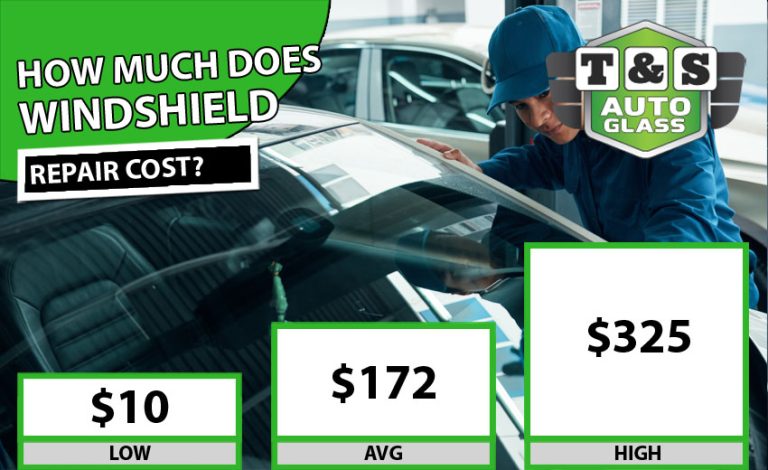

- Fees:

- Incoming wire transfers typically incur a fee from HSBC Hong Kong (e.g., HKD 50-100, depending on account type), plus possible intermediary bank fees (often USD 10-30).

- Currency conversion may involve a markup on the exchange rate. For better rates, consider services like Wise or Revolut, especially for large transfers.

- Processing Time: Transfers via SWIFT usually take 1-5 business days, depending on the sender’s bank, intermediary banks, and time zones. Providing complete and accurate details minimizes delays.

- Local Clearing Code: For local Hong Kong transfers, HSBC’s bank code is 004, but this isn’t needed for international SWIFT transfers.

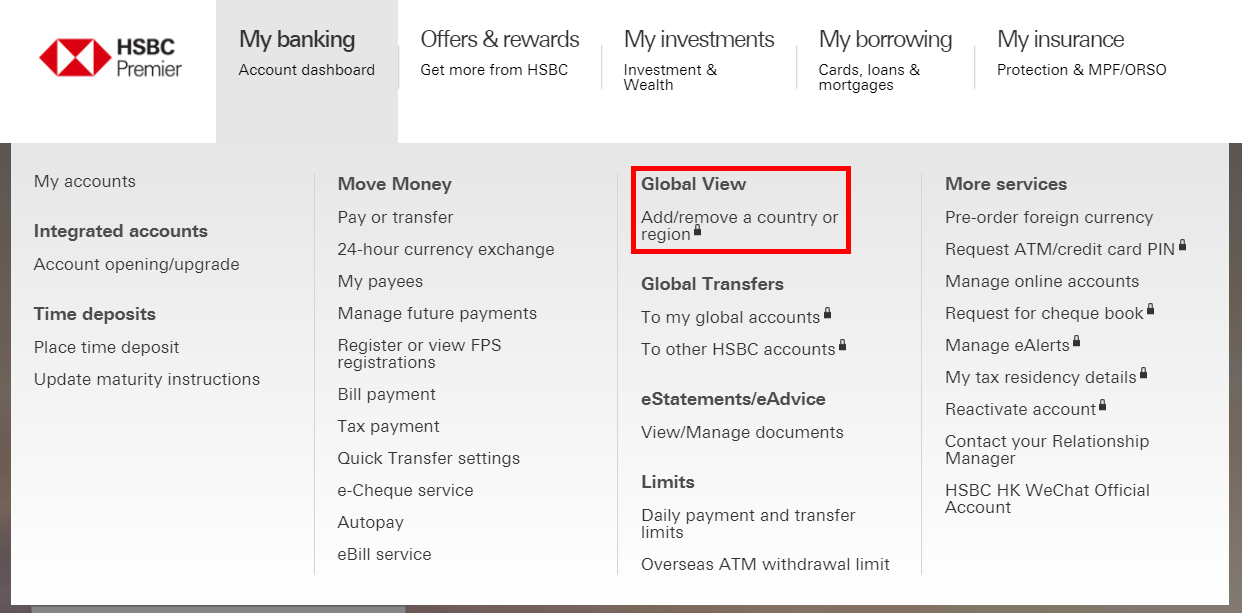

- Always confirm the SWIFT code and account details with your HSBC branch or through online banking, as specific accounts or services might occasionally require a different branch-specific SWIFT code (e.g., HSBCHKHHSFI for securities financing). However, HSBCHKHHHKH is the standard and most widely accepted code for general wire transfers.

- If unsure, contact HSBC Hong Kong customer service at +852 2233 3000 or log in to your online banking for confirmation.